4 Strategies for Creating and Preserving Wealth MVP Wealth Management Group

Post on: 31 Июль, 2015 No Comment

For years you thought creating wealth meant saving as much as possible – taking advantage of all of the available tax deductions, contributing to a retirement account and diversifying investments. Picking good financial advice from bad financial advice isn’t always easy, but when it’s touted as the way things are, it’s even more confusing. As society evolves, the advice you once thought was significant might be downright disastrous and outdated.

Saving for retirement is important, but conventional advice is not enough to build wealth and financial freedom. The following are just a few strategies for creating and preserving wealth you might not be currently implementing.

Proactive Tax Planning

Tax planning is not something that happens only at year-end. Establishing a year-round tax plan can help you reduce taxes and achieve your financial goals. A few tax planning opportunities that are often overlooked include:

- Charitable Donations – If you make a donation to a qualified charity, you may be eligible to receive a tax deduction on your federal and state return. Generally, you can deduct cash contributions up to 50 percent of your adjusted gross income, property contributions up to 30 percent of your adjusted gross income and contributions of appreciated capital gains assets up to 20 percent of your adjusted gross income.

- Harvesting Capital Gains – When you have a capital gain, you owe capital gains tax. However, the capital loss can either offset the capital gain. If there were no capital gains during the tax year, you could use up to $3,000 to reduce your regular income (if net losses exceed $3,000, you can carry forward any unused losses into future tax years).The long-term capital gain tax rate is 10 percent for taxpayers in the 15 percent tax bracket and below, 15 percent for those in the 25 percent to 33 percent tax brackets, and 20 percent for those in the highest income tax bracket. With the Affordable Care Act, those in the highest income tax bracket will be subject to an additional 3.8 percent tax on investment income

- Maximizing Tax Brackets – U.S. tax rates are at historical lows and your tax bracket is the rate you pay on the last dollar you earn (your tax rate is generally less as a percentage of your income). Taxable income is regularly taxed income minus adjustments, deductions, and exemptions. Qualified dividends and long-term capital gains are separate calculations. If you are in a lower tax bracket now, you are missing opportunities to take advantage of potential transfers that can result in smart financial gains.

Integrating tax-savvy strategies as part of a holistic financial plan can help you keep more of your hard earned savings. Remember that state tax laws apply.

Reviewing Your Investments

Investing can be an overwhelming and intimidating task for most. Your investments might be over-exposed to risk if your portfolio is concentrated in a particular category. Generally, having a lot of investments does not diversify a portfolio. On the contrary, over-diversifying will deprive you from the gains of well-performing investments. Focus on variety, not quantity.

So why aren’t people diversified? Surprisingly, many don’t even know how they are invested – whether it’s in stocks, bonds, mutual funds, or alternative investments. Several years ago many people didn’t care, because when they opened their statements, most were realizing substantial gains. Fast forward to today, market downturns and news of sophisticated investors getting scammed are motivating people to take a closer look. Still, many don’t really know what to ask, and are intimidated by their financial advisors.

People need to understand their investments, including what they should and should not be in. Stay current with your investments, remain alert with overall market conditions, and ask questions. Even though diversifying is important to control risk, don’t feel constrained about company names or fund providers.

Retirement Planning

Planning for retirement is not only about funding an IRA, 401(k), or other employer sponsored plan. It’s understanding how you may potentially be taxed in the future, choosing pre-tax or after-tax contributions, fees, investment risks, and how not to outlive your savings among other components.

Conventional advisors stuck in the past continue to use both the Rule of 100 (subtracting your age from 100 to determine how to invest among risk and non-risk accounts) and the 4 percent Rule (portfolios with 60 percent of their holdings in large company stocks and 40 percent in intermediate term U.S. bonds sustaining withdrawal rates starting at 4.15 percent, and adjusted each year for inflation). The potential risk of a prolonged negative market the first two or three years of your retirement can be detrimental. An annuity with an income rider can be a great option, especially if inflation accelerates more than the markets.

Also, now might be the time to act if you’ve been looking for a chance to convert a Traditional IRA (fully taxed) to a Roth IRA (tax-free) for tax-diversification purposes. Taxes are on sale, and the consequences might be minimal versus years ago, and probably more favorable than a few years from now, especially if income tax rates for higher earners increase.

Figuring out all the right moves can be more challenging when the economy and financial markets are in a free-fall. Never be embarrassed to ask for help.

Estate Planning

The federal estate tax exemption is $5,340,000 for 2014, and will continue to be increased. But, even if you have some assets, minor children, or simply want to your loved-ones to bypass probate (the expensive alternative), you still need an estate plan – even if taxes are not an issue.

Which legal documents are essential – a will, trust, durable power of attorney, healthcare proxy or all? It depends on whether you have substantial assets, a blended family, or intricate requests. There is never a one-size-fits-all scenario.

If you setup a living trust, you must transfer ownership of the assets for which you want to avoid probate to the trust. However, many people fail to transfer ownership, and the probate-avoidance advantage is lost.

If your estate is worth more than the exemption amount for federal estate taxes, no planning can lead your estate to be taxed as much as 50 percent, plus state taxes. If you do fit this example, a living trust is probably not the best option, because you will typically retain control of your assets. An irrevocable trust, on the other hand, might be more appropriate contingent on your goals.

If you currently don’t have a plan, now is a good time to set one up. And if you have an existing plan, you should review it at least annually and update as needed.

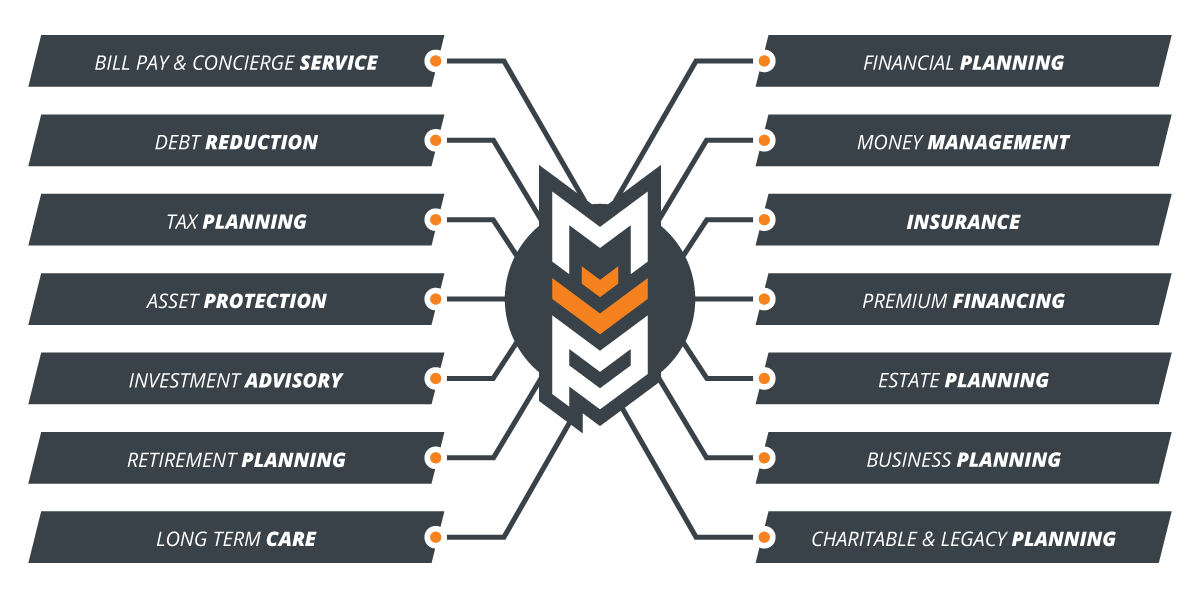

All in all, an effective, well-rounded plan should include tax, investment, retirement, and estate planning decisions.

4 Strategies for Creating and Preserving Wealth was last modified: February 20th, 2014 by carlosdiasjr