4 Reasons to Buy Silver and 3 Ways to Play It

Post on: 25 Июль, 2015 No Comment

If you’re easily shaken up by volatility, you might as well just get out of the metals market altogether.

Go put your money in some bonds and call it a day.

The truth is you’ll need a backbone to play in this space. Entire fortunes have been lost, and entire fortunes have been made here.

If you’re patient, however, it’s pretty much certain you’ll come out a winner.

I’ve been quietly waiting for silver to hit a floor this year, and it finally looks like we’re there.

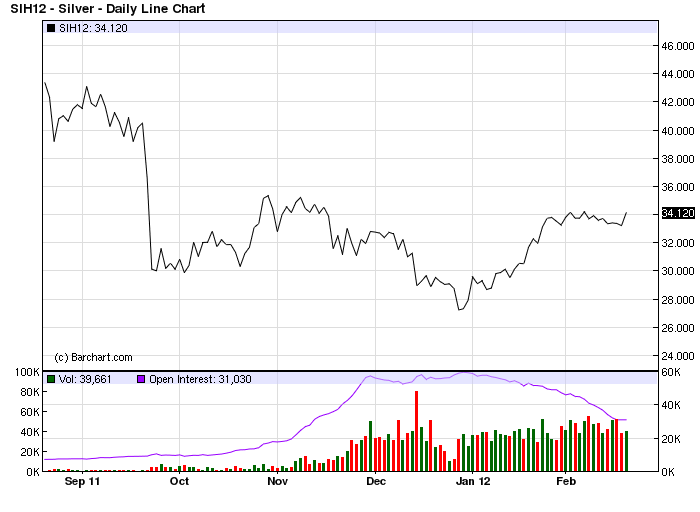

Support lines are beginning to curve upward, and with more than a 40% correction, we’re seeing a major discount in prices.

At the same time, there are several global catalysts that will have a positive impact on silver pricing over the years to come.

Below, I’ll share these catalysts with you along with the best ways to play silver’s impending rebound.

4 Reasons to Buy Silver Now

Catalyst 1: India Indicator

India is the single largest consumer of bullion in the world, so it pays to keep an eye on the nation’s silver habits.

2013 was the stuff of legends. As the silver price went down globally, consumption went through the roof in India. India’s first quarter 2013 silver demand was up to $1.78 billion a 311% increase from the previous year. In the first eight months of 2013, silver imports in India reached 4,000 tons, more than doubling imports during the entirety of 2012.

There were two driving forces behind this trend. First, India placed extremely tight restrictions on gold imports. As a result, sentiment in precious metals shifted towards silver. The second factor here is inflation. With the Indian Rupee inflating a staggering 9.3%, it’s no wonder the nation was buying as much silver as they can get their hands on. The peak silver import hit 5,819 tons in 2013, which was the all-time highest it had ever been.

By the end of the year, the buying spree was over. In June 2014, silver imports totaled just $212.8 million, which was 53.4% less than the same period in 2013.

While this seems like a dramatic fall, if we compare the first half of 2014 with the first half of 2013, the difference isn’t as stark. 1H 2013 was 2,980 tons, and 1H 2014 was 2,882.

Experts are predicting silver imports to continue to be subdued in 2014. But when you’re comparing to the highest level of consumption OF ALL TIME, anything but a shattered record will be a decline.

The truth of the matter is that the full-year 2014 imports are going to be around 5,000 tons, which is near the previous record high of 5,048 tons in 2008.

Catalyst 2: Global Manufacturing Rebound

Unlike gold, silver has a wide range of applications. It is found in jewelry, electronics, batteries, mirrors, solar energy, and water purification, just to name a few uses.

Industrial applications for silver make up nearly half of global silver consumption, and a rebound in global manufacturing is going to drive up demand.

The JPMorgan Global Manufacturing PMI has indicated growth for 19 months straight, while factories in the U.S. UK, and Asia reported increases in activity. The Eurozone hasn’t fared as well lately, but new orders are coming in quickly, and stocks have run down for their third month in a row.

According to a report by Thomson Reuters, silver industrial demand will rise to record highs in 2014, and will account for approximately 57% of total silver fabrication.

This demand will be fueled by manufacturing growth in the automobile industry, as well as a recovery in the housing and construction industries.

The effects can easily be seen in China, which now accounts for 18% of global silver demand more than double its stake in 2000.

China is now the number two industrial silver consumer, behind only the United States. Increased manufacturing in China will have a significant impact on global silver demand.

Catalyst 3: Tarnished U.S. Supply

In 2013, there were two devastating landslides at Rio Tinto’s (NYSE: RIO) Bingham Canyon mine in Utah, one right after the other. Over 165 million tons of rock came crashing to the mine floor, suspending production for an indefinite period of time.

This event was, without exaggeration, a catastrophe. It was called the biggest nonvolcanic landslide in the history of the United States, and is considered the first landslide to have triggered earthquakes (instead of the other way around, which is common). Fortunately, no one was injured by the slide.

The Bingham County mine is the second largest silver mine in the U.S. and accounts for a staggering 16% of national silver production. So we’re talking about four million ounces of silver per year that have essentially vanished a strong catalyst for a rise in prices in 2013.

Rio Tinto will continue recovery work in the Bingham Canyon Mine through 2015, but the effects of that landslide will be felt in silver, gold and molybdenum volumes for as much as a decade.

Catalyst 4: ETFs Are Stocking Up

Silver hit its peak value in 2010, launching from $16.94 per ounce all the way up to $45. Since then, the price has been correcting, but demand has remained strong.

In the first quarter of 2013, silver ETFs purchased 20 million ounces of silver. And in June of 2013, the world’s largest silver fund added a record of 572 tons to its inventory more than all of its 2012 purchases combined.

This is incredibly important, because it shows us what smart money thinks is happening in the market.

When some of the smartest money in silver is buying up vast amounts of the precious metal, we have a strong indicator that prices are bottoming out.

The last time this particular fund bought close to that much bullion, the price of silver nearly doubled in the following nine months.

With silver near a bottom, now is the time to put your money into the pot.

Historically, exposure to silver has been quite complex, but with the advent of precious metal ETFs, it’s gotten a whole lot easier.

Simple Silver Investing

For a small fee, ETFs are by far the simplest way to invest in silver.

Though it’s not the same as buying and selling physical silver, these funds consistently correspond with market pricing and remove the many complications of bullion investing.

Unlike buying physical bullion, ETF investors are not subject to paying commissions or storage fees when acquiring silver and gold. Instead, you are subject to small expense ratios, which are often trumped by the enormous gains these funds can bring to your portfolio.

The ETF I’m going to recommend below has an expense ratio of .05%, which could be considered quite hefty. However, this fund most accurately reflects silver pricing and provides a level of convenience and simplicity that is worth the fee.

iShares Silver Trust (SLV) is an ETF that seeks to reflect the price of silver owned by the trust. The company does this by matching its total shares outstanding with its total ounces of silver approximately .97 ounces of silver per available share.

SLV holds more than 10,620 tons of silver, making it by far the largest silver ETF on the market.

Not surprisingly, SLV is the most widely traded physically-backed silver offering, giving you a healthy level of liquidity.

Double and Triple Leverage

If silver is at a bottom, there is no better way to profit than from leveraged ETFs. This is because they are structured to amplify the returns of chosen benchmarks.

I must give you a fair warning, though: Leveraged ETFs are not for the faint of heart especially in an already volatile silver market.

Because these funds are designed to amplify returns, they will amplify losses as well.

That being said, your positioning in leveraged ETFs will depend on your tolerance for risk.

If you’re going to invest in silver defensively, stick with a non-leveraged fund like SLV.

If you like to take the bull by the horns however, the following two ETFs will maximize your gains.

ProShares Ultra Silver (AGQ) seeks to provide investment results that double the daily performance of silver bullion, as measured by the U.S. dollar fixing price.

The fund uses swap agreements, futures, options, and forward contracts to leverage their holdings.

You personally don’t have to worry about how the leveraging is accomplished only how successful that leveraging has been.

To get an idea of how effective leveraging silver can be consider this: From the start of 2009 to April 2011, the iShares Silver Trust was up 300%; yet in same time frame, AGQ gained an astonishing 1,000%.

For an even higher amount of leverage, look no further than VelocityShares 3x Long Silver ETN (USLV).

This fund seeks to replicate three times the S&P GSCI Silver index ER by using futures contracts. It has done a solid job of accomplishing just that since its inception in late 2011.

USLV is down 86% since its birth into a bearish silver market, as a result of its 3x leveraging. However, the stock has recently double-bottomed at around $50, and chart patterns are affirming a bullish trend reversal.

With silver ready to rebound, the upside to USLV right now is simply massive.

The Best Free Investment You’ll Ever Make

Sign up for the free Wealth Daily e-letter below.

In each issue, you’ll get our best investment research, designed to help you build a lifetime of wealth, minus the risk.