4 Factors That Made Gold This Decade s Best Investment

Post on: 25 Сентябрь, 2015 No Comment

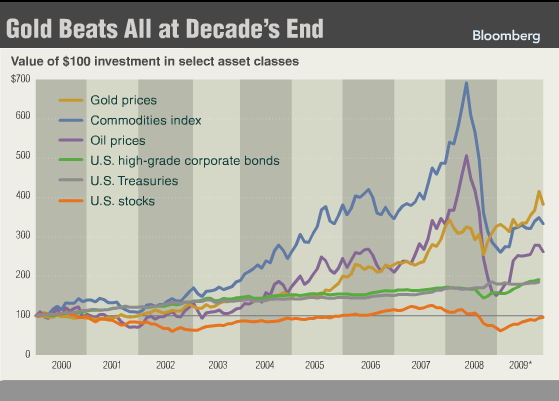

Gold has been on a decade-long hot streak; that’s something everyone knows.

But what is interesting is how great and sustained the increase has been. Since its inception at the end of 2004, the SPDR Gold Trust ETF (NYSE: GLD ) has risen 261%.

The price of gold itself quintupled in value against the dollar from April 2001 to its all-time high in August of $1,913 per ounce. Even though prices have cooled to around $1,600 per ounce, gold is still up 471% from 10 years ago, when gold prices stood at just $280 an ounce.

Unlike other precious metals like platinum, silver and copper, which have industrial uses, gold is mainly used for accumulation and investment .

The yellow metal has also been criticized by investors like billionaire Warren Buffett. You can fondle [gold], you can polish it, you can stare at it. But it isn’t going to do anything. I’d bet on a good producing business to outperform something that doesn’t do anything.

So why is gold considered so valuable?

The main reason: It’s been recognized for centuries as a limited form of currency. able to withstand economic pressures that paper currency cannot.

Gold is typically used as a safe haven during times of inflation. weak currency. economic instability and uncertainty or war. While we don’t have high levels of inflation right now, it is a looming threat that many fear is unavoidable.

With that said, let’s look at some of the main reasons why gold prices have been so high lately:

High Gold Price Reason #1: Weak Currency

When the dollar is weak (as it has been for almost a decade), many investors trade their dollars for gold as it better preserves its intrinsic value. That’s because it’s a limited resource and a medium of exchange that can’t be replicated or reprinted like paper fiat money .

Because gold is valued in dollars, a declining dollar value actually means the price of gold goes up. For example, let’s say for illustration purposes gold is worth $1 per ounce. If the dollar falls 10% in value, you’ll need $1.10 to buy the same ounce of gold because your dollar has less purchasing power ; thus gold would then be worth $1.10 per ounce.

Investors have been betting on gold as a hedge against the falling dollar as they believe that the greenback ‘s outlook remains weak and doesn’t look to make significant gains in the near future.

[Want to hedge with silver too? You can start with iShares Silver Trust ETF (NYSE: SLV ) along with our investing guide: My Favorite Ways to Own Silver Today ]

High Gold Price Reason #2: Government Deficits

While inflation hasn’t been a problem in the short term. the growing debt problem in the United States has some investors worried that inflation could be a big threat to the dollar’s value in the future.

#-ad_banner_2-#If the debt ceiling debate, Standard and Poor’s downgrade of the U.S. credit rating and the growing fiscal deficits have told us anything, it’s that the federal government is cash-strapped.

One way federal governments combat their own large deficits is by increasing the money supply in the economy through methods like quantitative easing (QE). The Federal Reserve used quantitative easing to pump more than $600 billion more into the U.S. banking system this year (on top of the $1.8 trillion it printed last year) in an effort to get money flowing through the economy again.

The goal of quantitative easing is to encourage investment and spending which will help lower unemployment ; however the downside is that it can make currency less valuable and potentially increase inflation. That fear of inflation has once again led investors to seek gold, driving up demand and gold prices further.

High Gold Price Reason #3: Low Interest Rates

Treasury bonds or U.S. Treasury bills are typically solid, nearly risk-free investments in uncertain economies. But with historically low interest rates, one-year Treasury bills are paying investors a return of less than 0.11%.

Because of record low interest rates, investors have a low opportunity cost ; in other words, they have little to lose by switching to another investment that could potentially yield higher returns.

Because gold is also seen as a low-risk investment (at least as far as preserving value) gold has been an easy alternative option for investors to sink billions of dollars into, especially with the attractive growth rates in the past few years.

High Gold Price Reason #4: Limited Supply Met With Heavy Demand

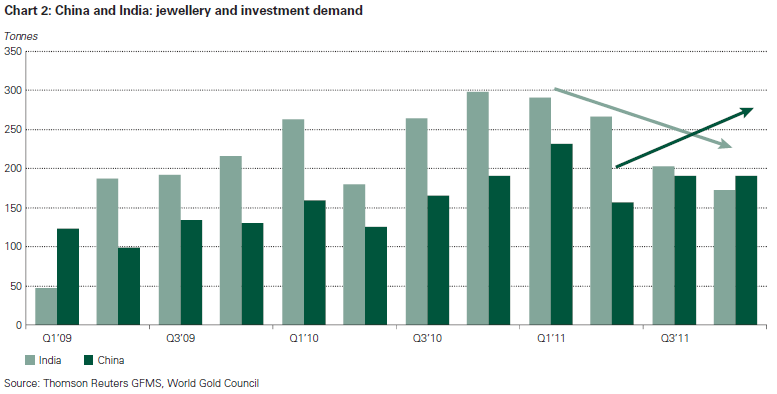

The ultimate reason gold prices have skyrocketed is due to supply restraints: The supply of gold being mined or recycled has not kept up with the record-high demand for the precious metal.

According to the World Gold Council. $52 billion worth of gold was sold globally to investors in 2010; a growth of 24% over the prior years’ record $43 billion.

Compare that kind of demand with a modest gold supply increase of only 2% for 2010 over the previous year, and you may start to see why gold prices have risen so quickly.

The Investing Answer: There are several reasons why gold is so valuable today; currency woes, economic and political uncertainty and low interest rates have all brought different types of investors to gold, pushing prices continually skyward. All signs point to these conditions continuing, but with recent gold price corrections it is hard to be absolutely certain of where prices are headed.