4 Bond Portfolios for More Income Less Risk

Post on: 12 Май, 2015 No Comment

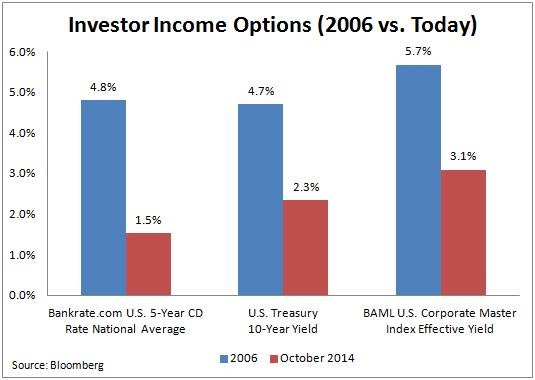

These are confusing times for income investors. Not so long ago, they loved bonds, which presented them with three decades of falling yields and rising prices. Last year, they hated ‘em, as the Federal Reserve’s talk about slowing the pace of its bond purchases led to generally lower prices. Then early in 2014, as the Fed’s taper talk turned into action, prices of high-quality bonds did the unexpected and rose as yields fell, rekindling investors’ affection for fixed-income investments. In the end, though, the problem that has bedeviled investors hasn’t disappeared: Interest rates remain at historically low levels, and to get extra yield, investors must take extra risks.

Recent results underscore the turmoil in the bond market. Barclays Aggregate Bond index, a broad measure of U.S. investment-grade issues, lost 2.0% in 2013 (its first calendar-year drop in 14 years) then rose 1.5% in January. Other sectors swung even more: Long-term government bonds, after losing 13.3% in 2013, gained 6.2% in January. But developing-markets debt sank 7.3% in 2013 and declined 2.5% in January (for more, see Buy Emerging-Markets Bonds ).

Through it all, though, some sectors have sparkled. Convertibles—stock-bond hybrids—returned 22.3% over the past year through January 31. And high-yield, or junk, bonds earned 6.7%. In bonds, somewhere, something is almost always working, says Jeff Moore, manager of Fidelity Investment Grade Bond. And if nothing is working, it’s just a short pause.

And that’s the lesson: It’s not that bonds don’t work anymore. It’s that what has worked for many investors in recent years—holding a mix of debt similar to the Aggregate index, which is heavy in Treasuries and doesn’t hold junk bonds—may not be the best combination for these times. As such, buying an index fund that captures the entire U.S. bond market could be a misstep. You need to be more targeted in this environment, says Brian Hahn, an adviser with money manager Neuberger Berman.

Putting aside the January drop in yields (much of it due to investors buying high-grade bonds to escape turmoil in emerging markets), chances are good that interest rates will resume their climb before long. So what’s a bond investor to do? To help you weather this uncertain market, we’ve assembled seven bond-fund portfolios designed to pay more than you can get from the bank while keeping duration (a measure of interest-rate risk) in check. Our portfolios yield from 2.1% to 3.6%.

We chose funds over individual bonds because we believe their benefits—particularly professional management and diversification—outweigh their shortcomings. What’s more, building a well-diversified portfolio of individual bonds takes at least $100,000, according to Fidelity, to achieve an optimal mix of issuers, sectors and maturities. Most bond funds, by contrast, let you through the door for $2,500 or less. (Three of our portfolios hold only exchange-traded funds; the minimum for an ETF is the price of one share, plus commission.)

Before investing in our models, decide how much of your portfolio you want in bonds. Then match your objectives as best you can with those suggested in our model portfolios. If necessary, tweak the allocations to meet your tolerance for risk. Walk before you run, says bond strategist Mary Ellen Stanek, of Robert W. Baird, a Milwaukee investment firm. Start with a conservative allocation, and as you get comfortable, take on more risk by readjusting the portfolio. The trick is to build an allocation you can stick with even when the market turns against you. Selling in a panic is a lose-lose situation, says Stanek.

Keep in mind that where you hold your bonds matters, too. Because interest payments on most fixed-income securities are taxed as ordinary income, money managers advise holding taxable bonds in a tax-deferred account, such as an IRA or a 401(k). If you’re investing in a taxable account and have a high income, you’ll probably be better off investing in municipal bonds. Interest from debt issued by states and cities is generally exempt from federal income taxes and may be exempt from state and local income taxes, too.

Low-Risk Portfolios: Trading Yield for Safety

These are for investors who may not be able to tolerate big losses in their bond portfolios. Or they may hold bonds to hedge against falling stock prices. To do that effectively, says Jeff Moore, a bond-fund manager at Fidelity, you need to buy what generally goes up when stocks go down. That means a combination of intermediate-term U.S. government bonds or government-guaranteed mortgage debt (such as Ginnie Maes), and investment-grade corporate bonds (debt that is rated between triple-A and triple-B, which indicates a relatively low risk of default).