3 Simple Steps to CrashProof Your Retirement Plan

Post on: 4 Июль, 2015 No Comment

The recent stock market slide is timely reminder to protect your retirement portfolio from outsized risks. Here’s how.

At this point its anyones guess whether the recent turmoil in the market is just another a speed bump on the road to further gains or the start of a serious setback. But either way, now is an ideal time to ask: Would your retirement plans survive a crash?

The three-step crash-test below can give you a sense of how your retirement plans might fare during a major market downturn. and help you take steps to avert disaster. I recommend you do this stress-test now, while you can still make meaningful adjustments, rather than waiting until a crisis actually hitsand wishing youd taken action beforehand.

1. Confirm your asset allocation. The idea here is to divide your portfolio into two broad categories: stocks and bonds. (You can create a third category, cash equivalents, if you wish, or throw cash into the bond category. For the purposes of this kind of review, either way is fine.)

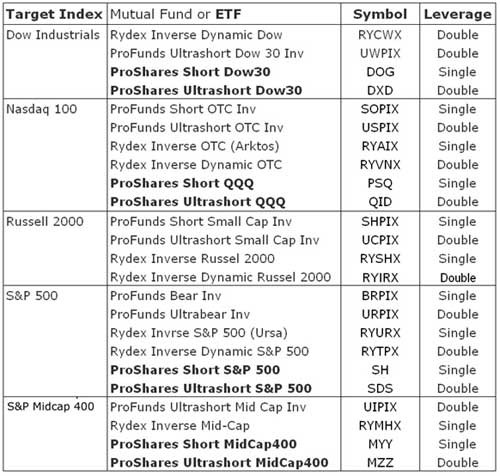

For most of your holdings this exercise should be fairly simple. Stocks as well as mutual funds and ETFs that invest in stocks (dividend stocks, preferred shares, REITs and the like) go into the stock category. All bonds, bond funds and bond ETFs go into the bond category. If you own funds or ETFs that include both stocks and bondstarget-date funds, balanced funds, equity-income funds, etc.plug their name or ticker symbol into Morningstars Instant X-Ray tool and youll get a stocks-bonds breakdown. Once youve divvied up your holdings this way, you can easily calculate the percentage of your nest egg thats invested in stocks and in bonds.

2. Estimate the downside. Its impossible to know exactly how your investments will perform in a major meltdown. But you can at least estimate the potential hit based on how your portfolio would have fared in past severe setbacks.

In the financial crisis year of 2008, for example, the Standard & Poors 500 index lost 37% of its value, while the broad bond market gained just over 5%. So if youve got 70% of your retirement portfolio in stocks and 30% in bonds, you can figure that in a comparable downturn your nest egg would lose roughly 25% of its value (70% of -37% plus 30% of 5% equals 24.4%well call it 25%). If your portfolio consists of a 50-50 mix of stocks and bonds, its value would drop about 15%.

Remember, youre not trying to predict precisely how the market will perform during the next crash. You just want to make a reasonable estimate of what kind of hit your retirement savings might take so you can get an idea of what size nest egg you may end up with when things get ugly.

3. Assess the impact on your retirement. Go to a retirement income calculator that uses Monte Carlo simulations and enter your nest eggs current value as well as such information as your age, income, when you plan retire, how your savings are invested and how much youre saving each year (or spending, if youre already retired). Youll come away with the percentage chance that youll be able to generate the income youll need throughout retirement based on things as they stand now. Consider this your before crash estimate. Then, get an after crash estimate by plugging in the same info, but substituting your nest eggs projected value after a downturn from step 2 above.

Youll now be able to gauge the potential impact of a market crash on your retirement prospects. For example, if youre 45, earn $80,000 a year, contribute 10% of pay to a 401(k) 70% in stocks and 30% in bonds that has a current balance of $350,000, you have roughly a 70% chance of being able to retire on 75% of pre-retirement salary, according to T. Rowe Prices Retirement Income Calculator. Were your portfolios value were to drop 25% to $262,500 in a crash, your probability of retirement success would fall to 55% or so.

Once you see how a major setback might affect your retirement prospects. you can consider ways to protect yourself. For someone like our fictional 45-year-old above, switching to a more conservative portfolio probably isnt the answer since doing so would also lower long-term returns, perhaps reducing the odds of success even more. Rather, a better course would be to consider saving more. And, in fact, by boosting the savings rate from 10% to 15%, the level recommended by many pros as a reasonable target, the post-crash probability of success rises almost to where it was originally.

If youre closer to or already in retirement, however, the proper response to a precipitous drop in the odds of retirement success could be to invest more cautiously, perhaps by devoting a portion of your nest egg to an annuity that can generate steady, assured income. Or you may want to maintain your current investing strategy and focus instead on ways you can cut spending, should it become necessary, so you can withdraw less from your portfolio until the markets recover.

Truth is, theres a whole range of actions you might takeor at least considerthat could put you in a better position to weather a market crash (or, for that matter, provide a measure of protection against other setbacks, such as job loss or health problems). But unless you go through this sort of stress test, you cant really know what effect a big market setback might have on your retirement plans, or what steps might be most effective.

So run a scenario or two (or three) now to see how you fare, assuming different magnitudes of losses and different responses. Or you can just wait until the you know what hits the fan, and then scramble as best you can.

Walter Updegrave is the editor of RealDealRetirement.com . If you have a question on retirement or investing that you would like Walter to answer online, send it to him at walter@realdealretirement.com .