3 Mutual Funds to Buy in 2015 as Bull Run Continues Mutual Fund Commentary

Post on: 16 Март, 2015 No Comment

Many market experts are predicting another year of solid gains for the markets. For the S&P 500, the growth expectations this year are as high as 13%, beating 2014’s increase of 11.4%. In fact, the Street sounds confident in believing that the prospects of the Federal Reserve raising rates this year should not be a cause for concern. Improving economic growth and strong corporate results are expected to continue to bolster the markets.

The year 2015 may have started on a sour note, but the economic indicators suggest that markets should shed the initial gloom banking on domestic strength. The US had left enough signs of bullishness in many economic indicators — healthcare, consumer confidence, housing numbers, manufacturing activities, corporate profits and currency. Remember, benchmarks had started 2014 on an almost equally dismal note, but went on to hit record highs.

Given the bullish views and the expected rally in the equities, it may turn out to be another profitable year for mutual fund investors, subject to radical events though. Interestingly, many believe that the US is in an early phase of recovery, and on verge of entering the mid phase in 2015. Fidelity explains the mid phase to be the longest phase for a business cycle. Economic activity gathers momentum, credit growth becomes strong, and profitability is healthy against an accommodative-though increasingly neutral-monetary policy backdrop, states Fidelity in this phase.

However, a Bull Run for the broader markets may not necessarily mean that every investment would follow the trend. If Real Estate sector mutual funds added 28% last year to lead the gains, there was also the Energy sector losing about 17%.  An article in The Wall Street Journal notes: As every year, the vast majority of stock-picking mutual-fund managers failed to keep pace with portfolios designed simply to track the broad markets.

Interestingly, strategists are said to be a ‘bullish bunch’. The average forecast has always called for increased returns each year since 2000, and they failed to predict the 2008 crisis or even the dot-com bubble. On the other hand last year, many had to raise their targets last year when their forecasts were short.

So, it is crucial to pick the possible winners prudently. The responsibility of efficiently managing a fund remains on the shoulders of a fund manager, but keeping a close watch on the performance of the funds is the investor’s responsibility. Times of volatility require more proactive portfolio management and the ‘buy and forget’ strategy doesn’t work. Nonetheless, to help investors identify potential winners, we will pick 3 mutual funds with top Zacks Rank among other factors that are most likely to exhibit strength. Before doing so, let’s look at the major factors to watch out for 2015.

Fed, Energy Price Slump in Focus

There may be plenty reasons coming up that will guide benchmarks through this year. Keeping the unforeseen events out, what we know already is the slump in crude prices and possibilities of Fed raising interest rates.

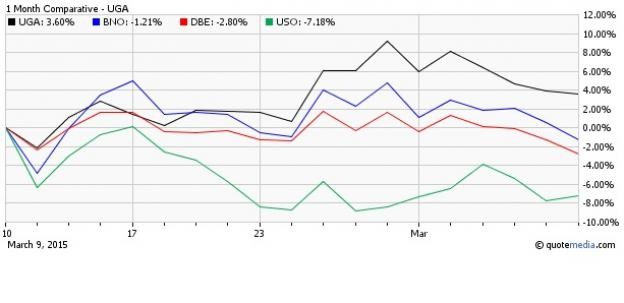

Crude Price Slump: The slump in crude prices has affected the energy sector heavily. Crude had dropped below $60 a barrel last year and it has continued the downslide to move below $50 a barrel. The West Texas Intermediate (WTI) crude price lost momentum in June last year and has since then been showing weakness. Energy mutual funds finished 2014 as the biggest loser after registering a 16.7% year-to-date loss. With oil prices tumbling, it will be difficult for U.S. shale producers to garner sufficient earnings to stay afloat in the industry. The slide may continue this year for a while.

However, a class of stocks gaining from this phenomenon is consumer staples. Lower gasoline prices should continue to boost consumer spending, and thus the consumer sector. A stronger dollar is also contributing toward making goods more affordable.

Also, fuel costs account for a considerable portion of expenses of trucking companies. The U.S. trucking industry is currently poised to benefit in two ways: 1) lower oil prices will reduce their operating expenditure, thereby boosting the bottom-line, and 2) capacity constraint in the form of driver shortage and new government regulations will drive top-line growth.

A decline in oil prices is probably even more crucial for airlines. Lower jet fuel prices have been a boon for the airline industry given the inversely proportional relation between crude prices and the value of aviation stocks. This has benefited airline stocks immensely as the cut in oil prices has reduced their operating expenses significantly, thereby aiding the bottom line.

Fed Rate Hike. The central bank’s aggressive stimulus measures bolstered stocks since the financial crisis in 2008. The Fed has kept interest rates at record low and conducted three rounds of asset repurchase programs. While the central bank ended asset purchases in October, it continued with low rates amid speculations that rates will be hiked. Now, it is highly speculated that the rate hike will come this year.

According to the latest minutes of the Federal Open Market Committee’s December meeting, the central bank would want to be reasonably confident that inflation will move back toward 2% over time. According to minutes of the Federal Reserve’s December meeting, officials believe inflation rate won’t climb to Fed’s 2% target for some time due to lower energy prices and stronger dollar. However, minutes stated: Most participants thought the reference to patience indicated that the Committee was unlikely to begin the normalization process for at least the next couple of meetings.  The central bank could raise key interest rates even with low inflation, but not before April.

Some are apprehensive that a higher rate may halt the rally. Higher rates increase borrowing costs, which may impact companies’ profit margins. Increased rates may also diminish the appeal for high-yielding sectors compared to bonds.

However, market experts are seeing the rate hike as a reflection of the domestic economy’s strength to withstand increased borrowing costs. RBC Capital Markets’ chief U.S. market strategist Jonathan Golub says there is obsession about the potential headwinds the rate hike may cause. But we’re talking about very good stock-market returns for two to three years from now, said Golub. Banks and money-management firms’ studies show that stocks should be trending north even after rate hikes.

We believe higher rates do not necessarily translate into drop in markets always, and vice versa. If the central bank has to hike rates to fight inflation, it is a positive for the businesses and will push markets up. Similarly, if investors believe that higher rates have come banking on strength in economy, markets would move further up.

3 Mutual Funds Poised to Surge in 2015

Here we will pick 3 mutual funds that carry a Zacks Mutual Fund Rank #1 (Strong Buy) or Zacks Mutual Fund Rank #2 (Buy ) as we expect the funds to outperform its peers in the future. Remember, the goal of the Zacks Mutual Fund Rank is to guide investors to identify potential winners and losers. Unlike most of the fund-rating systems, the Zacks Mutual Fund Rank is not just focused on past performance, but the likely future success of the fund.

These funds also have proven history of impressive performance, as they have minimum 20% returns over 1, 3 and 5-year periods. The funds have relatively low expense ratio, carry no sales load and have significant amount of assets. The maximum initial investment required is $5000.

T. Rowe Price Health Sciences (PRHSX) invests most of its net assets in firms that are involved in research, development, production, or distribution of products or services related to health care, medicine, or the life sciences. The fund may invest in companies of all sizes, but majority is put into mid to large-cap firms. Total health spending will probably trend up in 2015 as more people can avail the insurance under Obamacare, according to a report from PricewaterhouseCoopers. (Read: Healthcare Spending to Trend Up in 2015 ).

The fund carries a Zacks Mutual Fund Rank #2 (Buy). It has returned 32.6% over one year and has annualized returns of 37.4% and 27.5% over the last three and five years. The fund carries an annual expense ratio of 0.79% as compared to category average of 1.43%.

Fidelity Select Transportation (FSRFX) seeks growth of capital. The fund invests majority of its assets in common stocks of firms mostly involved in providing transportation services or ones that design, manufacture and sale transportation equipment. The fund invests in both domestic and non-US companies. Remember the falling crude price is a positive for transportation sector.

The fund carries a Zacks Mutual Fund Rank #2 (Buy). It has returned 28.9% over one year and has annualized returns of 27.6% and 22.4% over the last three and five years. The fund carries an annual

expense ratio of 0.84% as compared to category average of 1.39%.

T. Rowe Price Global Technology (PRGTX) seeks capital appreciation over the long term. The fund invests in companies that are expected to earn most of their revenues from the development, advancement, and use of technology. The fund invests in a minimum of 5 countries and 25% of the assets will be invested outside the US. We believe, technology industry is one of the top 3 industries that may surge this year. (Read: Top 3 Industries Ready to Take Off in 2015 ).

The fund carries a Zacks Mutual Fund Rank #1 (Strong Buy). It has returned 22.3% over one year and has annualized returns of 25.8% and 19.1% over the last three and five years. The fund carries an annual expense ratio of 0.95% as compared to category average of 1.55%.

About Zacks Mutual Fund Rank

By applying the Zacks Rank to mutual funds, investors can find funds that not only outpaced the market in the past but are also expected to outperform going forward. Learn more about the Zacks Mutual Fund Rank in our  Mutual Fund Center .

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report