2014 Bond Market Outlook

Post on: 16 Март, 2015 No Comment

The return potential is limited, but a severe downturn is unlikely

You can opt-out at any time.

Please refer to our privacy policy for contact information.

By now, anyone who pays attention even peripheral attention to the financial media is probably terrified about the 2014 bond market outlook. Media discussions about the bond market’s prospects have, in some quarters, taken on an increasingly apocalyptic tone, highlighted by this gem from Yahoo! Finance on November 28: “Take cover! Bond market ‘hell’ could be on the way”.

With this sort of coverage, fixed-income investors could be excused if they feel the need to stock up on bottled water and emergency lighting supplies. But in reality, the outlook isn’t quite that bleak. While the bond market as a whole is unlikely to deliver much in the way of total return in 2014, there’s also no reason to hit the panic button. Here, we look at the various issues that could impact market performance in the year ahead.

See the last section of this article for outlooks specific to each asset class, as well as a variety of expert opinions.

Fed Tapering a Key Consideration

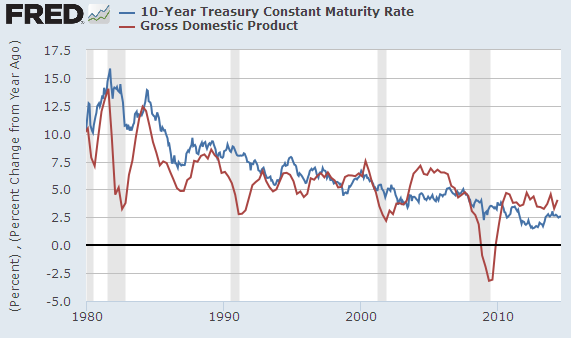

The key variable for the 2014 bond market outlook is, of course, the fate of the U.S. Federal Reserve ‘s quantitative easing (QE) policy. This bond-buying program, which was designed to depress long-term bond yields in order to stimulate the economy, has kept yields below levels where they would trade in a world without QE. During 2013, the prospect of a reduction in the program caused yields to jump as investors began to anticipate the eventual end of the policy. The 10-year Treasury yield, for instance, rose from a low of 1.63% on May 2 to near 3% by the close of the year. Keep in mind, prices and yields move in opposite directions .

Since this spike in yields reflected investors’ expectation of a coming Fed taper. it also means that a large portion of the taper-related sell-off is already factored into prices. The reduction of QE is a known issue that is fully anticipated by investors, so it isn’t realistic to expect that tapering — which is set to begin in January 2014 — will bring about another sell-off as large as what occurred in the spring-summer of 2013. Instead, the most likely outcome is a gradual tapering with the Fed telegraphing its intention well in advance.

Having said this, the need for the Fed to continue tapering is a modest headwind for bonds, both in terms of its potential impact on rates and its injection of uncertainty into the market. However, the extent of the downside from here may not be that substantial. Over time, the 10-year Treasury yield tends to gravitate to a level equal to the rate of gross domestic product (GDP) growth plus inflation. Assuming growth of 2.5% and inflation of 1.2% in 2014, that would put the yield on the 10-year at about 3.7% with no QE whatsoever. This isn’t the case, however: even with tapering, QE will continue through 2013. With yields already closing 2013 near 3%, this indicates that the worst of the sell-off may already have taken place.

How Could the Growth Outlook Impact Bonds?

Any outlook comes with variables, and the largest uncertainty regarding the 2014 bond market outlook is the direction of economic growth. If the economy strengthens to a greater extent than the current consensus expectation of 2.25% — 2.5%, this would raise concerns that the Fed would taper more quickly than expected. The bond market wasn’t particularly sensitive to the growth outlook in 2012 and the first few months of 2013, since investors were confident that the Fed would continue QE. Now, the growth outlook carries much more importance since it has a direct impact on the fate of quantitative easing .

The flip side, of course, is that growth could come in well below expectations, putting tapering on hold and providing the spark for a rally in bonds. This scenario is certainly in the realm of reason given that the economy still hasn’t fully recovered.

The Role of Inflation in the 2014 Bond Market Outlook

Inflation is key factor in bond market returns, but not one that has been a major issue for many years. Since the crisis, inflation has been depressed by the environment of slow growth and high unemployment. and it is likely to remain so for the foreseeable future. For this reason, this is the one issue nobody’s talking about with regard to the 2014 outlook – and therefore the one that could have the largest adverse impact on the market. While there’s no sign of inflation yet, keep an eye on this variable as 2014 progresses. As the saying goes, it’s the train you don’t see coming that hits you.

Will the Stampede out of Bond Funds Continue?

A third factor that could affect the 2014 bond market outlook is investor behavior. Investors sold their bond funds hand-over-fist in the second half of 2013, with many plowing the cash into equity funds to take advantage of the rising market – a phenomenon that has been dubbed the “Great Rotation .” Nobody can say for sure if this trend will continue in 2014, but the possibility of a continued flow of cash out of bond funds – which in turn forces managers to sell their holdings – could continue to pressure performance in the year ahead.

What Should Investors Expect in Terms of 2014 Returns?

It’s always a challenge forecasting performance a year out, since the unforeseen events inevitably factor into the equation. With that said, assuming that there are no major surprises (such as war, crisis, etc.) the most likely scenario is a year similar to 2013: above-average volatility and below-average returns. Absent an unexpected slowdown in growth, bonds are unlikely to offer much upside. From 2007 through 2012, bonds averaged steady returns between 5-8% per year. In the coming years, however, the average will probably be about half of that.

One reason for this weak outlook is that bonds and bond funds continue to offer historically low yields. While it’s easier to absorb a 2% price decline when yields are at 5-6%, that 2% decline becomes much more significant when investment-grade bonds are yielding in the 2-3% range.

Does this mean you should sell all your bond funds. Not at all – bonds continue to offer income, diversification, and relative stability to investors, and it’s always wise to stick with your longer-term plan rather than reacting to market developments.

Instead, the message regarding the 2014 bond market outlook is simple: temper your expectations.

Each individual’s situation is different, so an investment that may be a smart idea for one person may not necessarily be right for another. With that said, here are a few key points to consider as you look ahead to 2014:

Long-term vs. short-term bonds. Protecting yourself against downside risk should continue to be the name of the game in the coming year. If the bond market has another difficult year, long-term bonds will again underperform. On the other hand, short-term bonds are more closely tied to Fed policy than their long-term counterparts. With the Fed not expected to raise rates until 2016. the segment should continue to have support. Short-term bonds also offer the benefit of greater day-to-day stability to help investors ride out potentially volatile market conditions. In contrast, long-term bonds are the area of the market with the highest exposure to interest rate risk. and they aren’t offering enough extra yield to compensate investors for the potential downside.

High quality doesn’t mean “safe”. Bonds with the highest credit ratings – Treasuries. TIPS. highly-rated municipal bonds and corporate issues – lagged in 2013. While bonds in these areas have very low default risk. they also have high interest rate risk. Don’t assume that a fund that owns these “safe” investments will hold up better if the market weakens – the opposite may in fact be true .

Low quality doesn’t mean “unsafe”. Many of the best performing market segments of 2013 are those that tend to be the most volatile: high yield bonds. senior loans. and corporate bonds in the developed-international and emerging markets. In all cases, these asset classes tend to have below-average sensitivity to interest rates. While all will undoubtedly suffer any time investors lose their appetite for risk, they also can hold up better in an environment of rising Treasury yields. These investments aren’t for everyone, but they’re worth a look for anyone who can stomach the volatility.

Outlooks Specific to Each Asset Class

Learn more about what’s in store for these four key areas of the bond market in 2014:

What the Experts are Saying

Below are some key quotes from bond market experts regarding the 2014 bond market outlook. All parentheses are mine.

LPL Financial Research, Outlook 2014 / The Investor’s Almanac. “Interest rates are likely to continue to move higher and bond prices lower in response to improving economic growth. This growth will likely prompt the tapering of bond purchases by the Fed and increase the likelihood of a Fed rate hike in the middle of 2015. Bond valuations remain expensive compared to historical averages.”

Bill Gross. PIMCO co-Chief Investment Officer, December 2013 Investment Outlook. “The taper will lead to the elimination of QE at some point in 2014, but the 25 basis point (0.25%) policy rate will continue until 6.5% unemployment and 2.0% inflation at a minimum have been achieved. If so, (short-term) Treasury, corporate and mortgage(-backed securities) positions should provide low but attractively defensive returns.”

Deutsche Bank. Capital Markets Outlook 2014. During the first quarter, the US Federal Reserve is likely to start tightening monetary policy through so-called tapering; that is, reducing its bond purchases. After a volatile spell, markets should be calmer during the second half of the year, which will benefit emerging markets. Interest rate increases are unlikely to return to the agenda in the US until 2015.

Merrill Lynch . The Fed should wind down Quantitative Easing and yields should rise during 2014, except for very short-term securities. But we don’t think investors should be bracing for a long-term bear market or hiding out entirely in cash. 24/7 Wall St. 12/10/13

BlackRock, Global Intelligence, The Outlook for 2014 : We think the Fed will begin a gradual tapering program in the first or second quarter of 2014. We expect it will take more than one year to complete the QE wind up. This means the Fed is unlikely to begin using its traditional monetary tool — raising Fed Fund rates — to move short-term interest rates up from near zero until late 2015. We think this will translate into a fairly middle-of-the-road 75 basis-point (0.75 percentage point) rise in government 10-year bond yields in North America in 2014.

Bank of America. 2014 Market Outlook . Challenging year for fixed income. Tightening (yield) spreads and rising rates could make total returns challenging for fixed income investors. Corporates are favored over government bonds. High-yield bonds are expected to produce positive returns, though about half the gains seen in 2013. U.S. high-yield bonds may offer the best potential, with a total return of 4 percent to 5 percent.

Wells Fargo. 2014 Economic & Market Outlook: We expect the Fed will leave short-term rates

unchanged in 2014 and beyond. As a result, the pressure on longer-term rates is likely to be limited.

We do see long-term rates moving modestly higher in 2014 as the Fed scales back its bond purchases. In response, we have set our 2014 10-year Treasury year-end interest rate target at 3.50% and our 30-year Treasury target at 4.50%, a modest move higher from current levels. Such a move would likely result in below-average, but still positive, total returns for most fixed income investors.

Jeffrey Rosenberg, Chief Investment Officer, Blackrock. Traditional bonds could experience losses. Longer maturity bonds hold more. interest rate risk than shorter-maturity bonds, so be mindful of the maturities in your bond portfolio .

Since inflation is near flat, bonds designed to protect against loss of value to inflation might not be worth owning, such as Treasury Inflation Protected Securities (TIPS). Except in the longest maturities, in our view, they are expensive and we would keep them at a minimum in a portfolio.

Bonds that trade based on credit, or the ability of the issuer to pay back its obligations, offer a way to gain income with lower interest rate sensitivity. While not inexpensive, they generally offer higher yields and less sensitivity to interest rate increases. In particular, we favor high yield bonds . Seeking Alpha, 12/11/13

David Kotok, Founder of Cumberland Advisors. Has anyone thought that the bond sell-off might be overdone? The economy and its recovery are not so robust and not so impacted by rising inflation pressures as to cause bond interest rates to spike higher.

Maybe, just maybe, we will have low inflation, lower interest rates, and gradual economic recovery that will persist for quite some time. Maybe, just maybe, the backup in home mortgage interest rates will slow the housing recovery so that it will not be robust. The recovery in the labor market may also persist slowly, as the evidence seems to show.

At Cumberland, we do not view the world as coming to an end in bond land. When a high-grade, long-term tax-free yield of 5% is obtainable in a very low-inflation environment, we think that bond investors who run from bonds and liquidate them will look back, regret the opportunities they missed, and wonder why they did it. The Big Picture blog, 12/15/13

Schroeders, Outlook 2014: US Fixed Income. The Fed has purchased nearly as much long-term Treasury debt as has been issued in 2013, so a new buyer will need to be found in 2014 when the Fed gradually exits QE. But before we become too bearish, the complete absence of inflationary pressures in the US will prevent long-term interest rates from accelerating upward. Cash yields paying next-to-nothing will occasionally entice yield hungry investors to reach into longer maturities for returns.

Franklin Templeton Investments. We believe Treasury yields, after a measured rise during 2013, are likely to rise further in 2014. This rise should simply be seen as a normalization that mirrors optimism about the ongoing, rather unspectacular recovery of the US economy and the unlikelihood that short-term interest rates will go up anytime soon. Ultimately, long bond yields should reflect expectations of long-term economic growth and inflation. While we believe there are indications that economic growth might be picking up, inflation measures remain subdued, potentially capping long-term rates even as the Fed unwinds its asset purchases. Seeking Alpha, 12/20/13

Ilias Lagopoulos, Fixed-income strategist at RBC Dominion Securities. Our forecast is not for a bear market for fixed income in 2014, but we are at the initial stages at a rate normalization process, so I think it will be quite a challenging year. Reuters, 12/23/13

Rick Reider, BlackRock. As long as demand exceeds or equals supply, there’s no bubble. I would argue there’s too much demand today. There are not enough fixed-income assets in the world.

There is an extraordinary collision happening: Much of the developed world is reducing its debt, so there are not enough bonds. Yet the population is aging, which means pension funds and life insurers want bonds. And the Fed is buying up available supply. Barron’s, 12/28/13

David Fabian, Managing Partner at FMD Capital Management: Bonds shouldn’t be ignored, but rather implemented in a strategic manner to achieve your investment goals with the knowledge that there may be speed bumps along the way.

Picking the right fixed-income ETF or mutual fund that suits your needs is all about evaluating your risk tolerance and investment objectives. You should do some analysis of top performing funds from previous years and ask yourself how they will perform under certain scenarios. If the Fed decides to speed up or slow down its taper agenda, you may have to shift your portfolio to cope with changing dynamics. In addition, it’s important to keep an eye on the health of equity and credit sensitive markets as these will impact the bond market in the coming year ahead. Nasdaq.com, 12/31/13

Tony Crescenzi, PIMCO. “The Fed will … put less emphasis on its bond buying and instead focus on its forward guidance in hope that it can convince investors that there will be plenty of presents under the tree for quite a long time, with the policy rate staying at zero probably until at least 2016. This, along with the [Fed’s] strong determination to boost inflation, is a reason for bond investors to stay focused on short and intermediate maturities and to avoid maturities beyond 10 years, where the Fed’s bond buying has had the most effect.” Marketwatch, 1/2/14

Citi Private Bank : We expect further equity market gains to come, and still see current valuation anomalies as more serious in fixed income markets…. In summary, we remain bullish on growth prospects, and expect equities to outperform fixed income for a meaningful period ahead following years of profound monetary easing. Barron’s, 1/7/14

Morgan Stanley Wealth Management : We believe this year the broad investment grade and high yield markets will generate returns of roughly 0% to 1% and 3% to 4%, respectively, based on coupon income and modest spread tightening offset by rising yields and falling prices. Barron’s, 1/8/14

Bill Gross, PIMCO. . (if) inflation stays below 2.0% and inflationary expectations don’t rise appreciably above 2.5%, then a 3-4% total return for (investment-grade bonds in) 2014 is realistic. 1/9/14

Disclaimer. The information on this site is provided for discussion purposes only, and should not be construed as investment advice. Under no circumstances does this information represent a recommendation to buy or sell securities. Always consult an investment advisor and tax professional before you invest.