2 Tactical Municipal Bond Strategies For NonQualified Retirement Portfolios SPDR Nuveen S&P High

Post on: 5 Май, 2015 No Comment

Summary

- This article presents two tactical strategies employing tax-free (income), municipal bond ETFs, and is best suited for non-qualified (taxable) retirement accounts.

- The first strategy selects (semi-monthly) the top-ranked ETF based on relative growth and volatility.

- Limited backtesting (2009-2014) shows this strategy could produce 13% annual growth (no taxes on income) with a maximum drawdown of only 5.5%.

- A second tactical strategy is presented that uses the tax-free municipal bond ETF HYMB.

- This strategy uses short duration moving averages, and has the potential of giving annual returns of 13% with a maximum drawdown of only 2.0%.

Recently, someone asked if I could develop a tactical bond strategy using municipal bond ETFs. The purpose, of course, was to benefit from the income tax-free status of these ETFs in non-qualified (taxable) retirement accounts. So I recently set out to find such a tactical strategy, a strategy I will name MBS for Municipal Bond Strategy.

MBS selects the best ETF at the start of each semi-monthly period from a universe of six ETFs. The ETFs in the universe are the following:

1. SPDR Nuveen Barclays Build America Bond ETF (NYSEARCA:BABS )

2. SPDR 1-3 Month T-Bill ETF (NYSEARCA:BIL )

3. Market Vectors High-Yield Muni ETF (NYSEARCA:HYD )

4. SPDR Nuveen S&P High Yield Muni Bond ETF (NYSEARCA:HYMB )

5. SPDR Short-Term Municipal Bond ETF (NYSEARCA:SHM )

6. SPDR Nuveen Barclays Muni Bond ETF (NYSEARCA:TFI )

All of the ETFs are tax-free except BIL. BIL is just a proxy for cash in this case.

The ranking of the ETFs for each period is based on relative growth and volatility. I use a 5-day growth ranking and a 20-day volatility ranking. The growth ranking is based on total return. The two rankings are weighted 75% and 25% respectively to arrive at a final ranking. The top-ranked ETF is selected at the start of each semi-monthly period (two times per month).

In the figure below, I show ETFreplay backtest results for the strategy from 2009 to present. I know the limited amount of backtesting brings with it many concerns, but it is what it is. These ETFs do not have a long lifespan. I am certainly concerned about how the strategy will do in a rising rate environment, but it showed decent results in 2013 when long-term rates increased due to the threat of qualitative easing by the Federal Reserve. So maybe this strategy will provide adequate growth even in a rising rate environment.

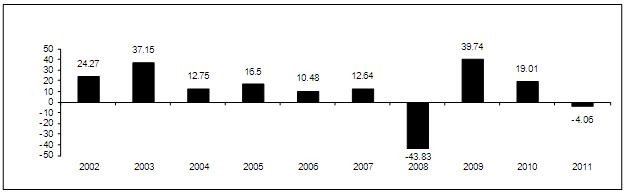

The ETFreplay results show a Compounded Annual Growth Rate, CAGR, of 13.1%, a volatility of 7.1%, a Sharpe Ratio of 1.77, and a maximum drawdown of 5.5%. These are pretty good results for a bond strategy, and compare favorably with my previous Bond-Only Strategy that uses taxable bonds. The benchmark for comparison is the iShares Core Total US Bond ETF (NYSEARCA:AGG ), and the MBS beats AGG every year, significantly in all years except 2010. Please note there are positive returns every year, even in 2013.

In conclusion, MBS provides a conservative tactical strategy that can be effectively used in taxable savings accounts. The total returns should hopefully average 13% annually with significant risk mitigation. And there will be no taxes on the income (although there will be taxes on the gains). I plan on giving semi-monthly updates for this strategy on my Seeking Alpha Instablog, starting July 16, 2014. The next provisional pick is SHM (as of July 3, 2014).

Short Duration Moving Average Strategy (SDMAS) on HYMB

In the course of developing the first strategy, I discovered there is a municipal bond ETF named HYMB that has rather low volatility and reasonable growth on its own. As I have shown in previous articles, ETFs that exhibit low volatility lend themselves to short duration moving average strategies that enhance overall performance. Backtesting could only be performed from 2011-2014 for HYMB, but the feasibility of this moving average methodology has been reported in a previous article (with backtesting to 2000 using a low volatility mutual fund proxy). Here’s the link to my previous article.

I decided to use the crossover of two moving averages: the 2-day and 22-day simple moving averages. I used simple (not exponential) moving averages because that is the only option available in ETFreplay. Changing the number of days on the larger moving average between 20-day and 30-day had only a secondary effect on the overall performance. The 2-day moving average was selected to reduce the number of trades (versus not having a second moving average). In previous studies I have used a 3-day moving average for the shorter moving average; this time I used a 2-day moving average because the performance was a little better.

The strategy is quite simple: if the 2-day moving average of HYMB is above the 22-day moving average, HYMB is owned in the portfolio. When the 2-day moving average becomes less than the 22-day moving average, HYMB is sold and the money goes to cash (to money market).

I used the ETFreplay software to calculate the backtests. The results are shown below. The green line that is labeled Equity Curve is really the results of this strategy. Going from June 1, 2011 to July 3, 2014, the SDMAS on HYMB using the crossover of the 2-day and 22-day moving averages gave a total return of 44.8% and a maximum drawdown of 2.0%. The maximum drawdown of 2.0% is a quite remarkable number. The CAGR is 13%, a number that is similar to the previous MBS. The worse year was 2013 when the strategy only produced a 4.8% growth; however, 2013 was the year of the threat of quantitative easing by the Federal Reserve that caused havoc with most of the bond market.

The number of trades each year were: 7 in 2011 (partial year), 7 in 2012, 12 in 2013, and 6 in 2014 (partial year). The current position of the strategy is risk-off (i.e. the 2-day moving average has just recently crossed below the 22-day moving average). I use the Schwab platform, and HYMB is commission-free on Schwab, so trading HYMB does not carry a commission fee. This, of course, greatly improves net performance.

The easy way to keep track of this strategy is to use the free chart capability found at stockcharts.com. Other free charting capabilities that I am aware of do not chart total return (that includes dividends), and this strategy requires a calculation using the total return of HYMB. So if you want to employ this strategy in your own account, please use the calculations found at stockcharts.com.

In conclusion, this second strategy also has the potential of growing accounts 13% annually with very low risk of drawdown. And once again, the income is tax-free (although a significant amount of the earnings are taxable); this makes the strategy advantageous for taxable savings accounts. The nice feature of short duration moving average strategies is that money can be made even when the overall performance of an ETF is negative in a given year. This is because the strategy allows you to sell an ETF early in the downturn, and buy it again early in the upswing. But the SDMAS only works for low volatility ETFs like HYMB.

Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it. The author has no business relationship with any company whose stock is mentioned in this article.

Conduct in-depth research on HYMB and 1,600+ other ETFs with SA’s ETF Hub