14 Types of Bond ETFs

Post on: 25 Сентябрь, 2015 No Comment

Different Bond ETFs for Your Portfolio

You can opt-out at any time.

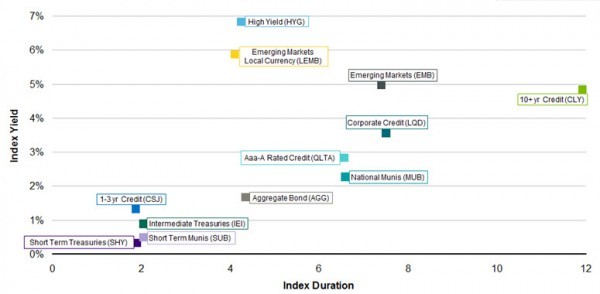

There are many ways to use bond ETFs in your investment strategy. Hedge inflation, interest rate plays, create revenue streams, invest in foreign regions. With that in mind, here are 14 types of bond ETFs to achieve your investment goals.

1. Corporate Bond ETFs

Companies issue debt in the form of corporate bonds to raise capital, which are traded on primary and secondary markets. In some cases, select corporate bonds are included in an index like the Wachovia High-Yield Bond index, which becomes an underlying asset tracked by a corporate bond ETF.

In this case, PHB, the PowerShares High Yield Corporate Bond ETF, tracks the Wachovia Corporate Bond Index. Corporate bond ETFs tend to consist of the corporate bonds that are included in the underlying index, but the funds also utilize derivatives like swaps and options in order to accurately create returns.

2. U.S. Treasury Bond ETFs

Treasury bonds (also known as T-Bonds or Government Bonds) are issued and backed by the US Government and tend to have less risk than corporate bonds. They have durations of over 10 years, make semi-annual interest payments, and are taxed on the federal level. They are initially bought through an auction and prices can range from $1,000 to $5,000,000.

An example of a treasury bond ETF is ITE – the SPDR Lehman Intermediate Term Treasury ETF tracks the Lehman Brothers Intermediate U.S. Treasury index, which is designed to emulate the performance of the 1-10 year sector of the United States Treasury market.

3. Municipal Bond ETFs

Muni bonds (or local government bonds) are also issued to raise capital, however a local government is the debt issuer. Municipal bond ETFs track indexes that consist of local government bond products.

Muni Bond ETFs tend to have low risk and return compared to corporate bond funds. Also, ETFs have a tax advantage over other types of investments, but when it comes to muni bond ETFs, the tax benefit is slightly different in the fact that muni bond ETFs are tax-free.

If you would like to see some municipal bond ETFs, look no further than our list of muni bond ETFs .

4. Inflation-Protected Bond (TIPS) ETFs

An inflation-protected bond ETF changes in value as inflation rates increase. If inflation rises, the value TIPS securities rise, adjusted for the rate. However, as rates fall, the values of the TIPS do not. The government guarantees the face value.

A fund like TIP, the iShares Barclays TIPS Bond ETF, tracks a TIPS Bond index, like the Barclays Capital U.S. TIPS index. TIPS bond ETFs allow investors to hedge against inflation and gain access to inflation-protected bond markets.

5. Broad Bond ETFs

If investors want to utilize bond ETFs in a portfolio, but don’t have an opinion about duration, yield, or rates, then a broad bond ETF may be a fit. There are broad bond ETFs that track corporate or government bonds.

An example of a broad bond ETF is AGG — the iShares Barclays Aggregate Bond ETF, which tracks the Barclays Capital U.S. Aggregate index consisting of investment grade bonds.

6. Short-Term Bond ETFs

In the case of an investor who has short-term goals, a short-term bond ETF like BSV, the Vanguard Short-Term Bond ETF, may be the way to go. USY consists of bonds with durations under 6 months, but others can have durations of 1-3 years like those in the iShares Barclays 1-3 Year Credit Bond ETF (CSJ)

7. Intermediate-Term Bond ETFs

Intermediate bond ETFs are a fit for investors who have longer investments goals, but don’t want to hold too long. For example, IEF, the iShares Barclays 7-10 Treasury ETF, consists of bonds with durations ranging from 7 to 10 years. Whereas IEI, the iShares Barclays 3-7 Treasury ETF, consists of bonds with 3 to 7-year durations.

8. Long-Term Bond ETFs

Another type of bond ETFs are those consisting of bonds with long-term durations. For example, the Vanguard Long-Term Bond ETF (BLV) consists of bonds with durations of 15 to 30 years.

9. International Bond ETFs

An international bond ETF may be your way to gain access to an emerging market, hedge foreign risk, or make a play on international interest rates. Like muni bond ETFs, these bond funds are backed by a government, but in this case a foreign government.

The risk reward may vary depending on the region and the tax implications may differ as well. However, there are different types of international bond ETFs like emerging markets. TIPS, and treasury. If you want to explore these types of bond funds, look no further that our list of international bond ETFs .

10. Inverse Bond ETFs

Some investors may have restrictions on their trading accounts or limitations that prevent them from short-selling ETFs. Enter inverse bond ETFs, a way to get short without selling. Inverse ETFs are constructed to emulate the inverse performance of an underlying index or asset.

Two examples are the ProShares UltraShort Lehman 7-10 Year Treasury ETF (PST) and the ProShares UltraShort Lehman 20+ Year Treasury ETF (TBT), but you can see the full list here.

11. Leveraged Bond ETFs

Coincidently, the first two inverse bond ETFs are also leveraged bond ETFs. Leveraged ETFs are designed to emulate a multiple return on an underlying index. However the important distinction is that the goal is to improve on the daily return, not the annual return. This has been one of the main controversy points for leveraged ETFs. If you want to see for yourself, check out.

12. Convertible Bond ETF

A convertible bond ETF consists of a corporate bond that can be redeemed for common shares of stock of the debt issuer. An example is the SPDR Barclays Capital Convertible Bond ETF (CWB)

13. Mortgage-Backed Bond ETFs

A mortgage-backed bond ETF does give a portfolio exposure to mortgage-backed securities, however the assets in the fund are not those of high-risk, sub-prime mortgages. A very important distinction, which keeps the risk level in check.

The first one launched in April of 2009 – MBB, the iShares Lehman MBS Fixed-Rate Bond Fund.

14. Junk Bond ETFs

Junk bond ETFs like HYG – the iShares iBoxx $ High Yield Corporate Bond ETF, tend to have low credit ratings, high yields, and therefore high risk. So if this type of investment appeals to you, a junk bond ETF may be a fit for your portfolio. And to see them in action, check out the list of junk bond ETFs .

Ready to trade bond funds now? Check out our list of bond ETFs