10 By 10 A New Way to Look at Yield and Dividend Growth Dividend Growth Investor

Post on: 17 Август, 2015 No Comment

Wednesday, November 19, 2008

10 by 10: A New Way to Look at Yield and Dividend Growth

By David Van Knapp

David Van Knapp is the author of two books on stock investing. The first is Sensible Stock Investing: How to Pick, Value, and Manage Stocks , which has a 5-star reader rating on Amazon.com.

www.SensibleStocks.com

Dividend investors often set minimum requirements for an acceptable initial dividend yield and/or dividend growth rate when they are considering buying a dividend stock.

Thus one investor might say, I wont invest in a dividend stock with a starting yield less than 3%. Another might say, I want a minimum 10% per year dividend increase.

The goal, of course, is to purchase stocks whose yields and dividend growth rates are high enough to make them better bets than safer fixed-income investments like money market accounts, certificates of deposit, and bonds.

The dynamic that determines the goal of high enough is how a stocks initial dividend yield and annual dividend growth rates interact over time. Obviously, a 6% initial yield will require a lower annual growth rate than a 2% initial yield to achieve a given return within a given time. By the same token, a 6% initial yield will get to a given return faster than a 2% initial yield for any given rate of growth.

Most dividend investors have a long-term holding period in mind when they buy dividend stocks. They are not looking to trade them often, but rather to hold them, allowing time for the dividends to increase and compound, until the stock itself becomes a money-generating machine irrespective of the stocks price fluctuations.

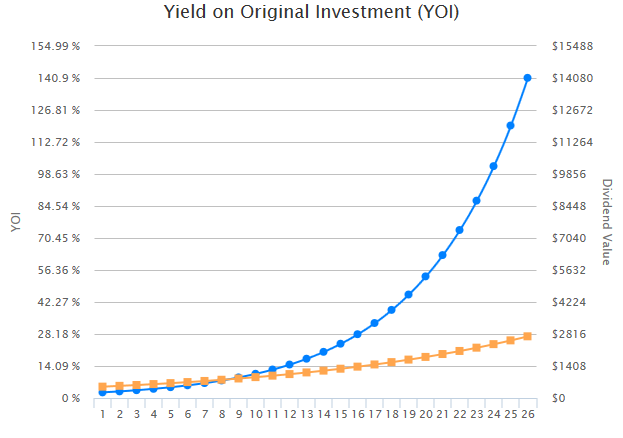

Here is a useful way to look at this: Look for stocks that will achieve a 10% dividend return on your original investment within 10 years time. I call this the 10 by 10 approach.

The two 10s are arbitrary, of course. You can put in any goals you like. I chose 10 and 10 because:

10% is a healthy rate of return, almost equal to the long-term total return of the stock market itself, which most studies show is between 10% and 11%. (Total return includes price appreciation as well as dividend return.)

10 years is a useful time frame for people of most ages. Young people, of course, have a much longer investment timeframe, but nevertheless may consider 10 years long enough to wait for the kind of return they are seeking. Older peoplesay in their 60s and 70sstill often think in terms of timeframes at least as long as 10 years, since just by having lived to their current age, their life expectancy usually is longer than 10 years from right now.

And, of course, 10 is a nice round number. It is easy to think in terms of 10% return and a 10-year timeframe to get a good grasp of the underlying principles.

So the question becomes simple: What initial yields, compounded at what rates of growth, achieve 10% return within 10 years?

The following table answers that question. It shows initial yields (across the top) and annual growth rates (down the side). Where any two values intersect, the table shows how many years it takes to achieve a 10% dividend return. Beneath the table are a few notes on calculation and interpretation.

Notes:

- The table ignores the contribution of price increases. It shows only the rate of return based on increases in the dividend over time.

- The rates of dividend increase should be considered average annual rates. It is rare for a company to increase its dividend by the same percentage amount each year.

-The table does not include the accelerating effect of reinvesting the dividends, which would shorten the times shown. It just shows the increase in your yield from growth in the dividend itself.

- In calculating the tables values, all years were rounded to the nearest year that a 10% return (from dividends alone) would be achieved. Thus all years appear as whole numbers.

Returns were also rounded, so the year that a return reached 9.6% was counted as the year it hit 10%.

- The sweet spot wherein the 10 by 10 goal is achievable has been shaded. So, for example, a 4% initial yield growing at 10% per year achieves the same result as a 5% initial yield growing at 7% per year: Both reach a 10% return (from the dividend alone) in about 10 years.

A few interesting conclusions jump out from this table. First, a 2% initial yield cannot reach the 10 by 10 goal at any rate of increase up to 15% per year. You cant get there from here.

Second, the table demonstrates that the initial yield is somewhat more important than the rate of dividend growth. An additional 1% in the initial yield reduces the time it takes to reach 10% return by around 20% to 30% (say by two to three years in the heart of the table). For comparison, an additional 1% in the annual rate of dividend growth reduces that time less dramatically (one to two years in the heart of the table).

Third, an additional 1% rate in initial yield reduces by 2% to 4% the growth rate needed to reach 10% return in a given time. In the example cited earlier (see number 6 above), a jump in initial yield from 4% to 5% reduced the dividend growth rate needed to achieve 10% in 10 years by 3% per year.

This latter point is important. The faster you hit your 10% dividend return rate goal, the fewer years that your stock choice is subject to prediction riskthat is, the risk that you overestimated its rate of dividend growth. As all dividend investors know, their initial rate of return is fixed at the time of purchase, but the future rate of dividend growth is somewhat speculative. Also, the higher the rate of projected dividend growth, the lower the probability that it will actually be achieved. Getting to your goal in fewer years is generally better all around.

As stated earlier, investors with other goals may plug in different numbers besides the 10 and 10 that I selected. Maybe you want to achieve 12% dividend yield within 9 years, or 10% yield within 7 years. It is easy to modify the table to show the combinations of initial yield and dividend growth rate you need to achieve those goals. The underlying principles remain the same.