Archive for Март, 2017

California CPA. June 2010 Asset allocation after the ‘Great Recession’ By Joel H. Framson CPA Whether we manage the money ourselves or act as

7 Апрель, 2015 No Comment Read More

Use the McClellan Oscillator to Determine Breadth

Use the McClellan Oscillator to Determine Breadth

The McClellan Oscillator is a popular market breadth indicator that can be used for market timing for short term traders. This indicator can give

7 Апрель, 2015 No Comment Read More

Comparing the Performance and Tax Advantages of Index Mutual Funds v ETFs

Comparing the Performance and Tax Advantages of Index Mutual Funds v ETFs

A reader e-mailed me an interesting article about index funds from todays Wall Street Journal entitled A Close Race, a Surprising Finish. Its only

7 Апрель, 2015 No Comment Read More

A Look at All the VIX ETF Choices

A Look at All the VIX ETF Choices

The impressive ETF boom that has unfolded over the last several years has been the result of a number of attractive features of the

7 Апрель, 2015 No Comment Read More

Alamo Capital Zero Coupon Bonds

Alamo Capital Zero Coupon Bonds

Alamo Capital has specialized in zero coupon bond investing since 1987. We run an in-house fixed income trading desk that maintains a competitive zero

7 Апрель, 2015 No Comment Read More

Finance jobs for a high level real estate finance career

Finance jobs for a high level real estate finance career

You could be working for either a commercial bank or an investment bank and specialize in real estate. The two roles are very different,

7 Апрель, 2015 No Comment Read More

Canadian Gold Mining Company Average Gold Ore Value Chart

Canadian Gold Mining Company Average Gold Ore Value Chart

Correlation Between Average Ore Value per Tonne and Enterprise Value per Ounce of Gold Equivalent GoldMinerPulse has been tracking fundamental metrics of the TSX/TSXv

7 Апрель, 2015 No Comment Read More

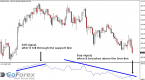

Accumulative Swing Index And The McClellan Oscillator

Accumulative Swing Index And The McClellan Oscillator

The accumulation swing index (ASI) is a variation of Welles Wilder’s swing index. It plots a running total of the swing index value of

7 Апрель, 2015 No Comment Read More

A study on oil and gas reserve accounting

A study on oil and gas reserve accounting

The aim of the investigation project is find out what similarities and differences in oil and gas reserve accounting in Russia, Norway and The

7 Апрель, 2015 No Comment Read More

Our objective is to identify opportunities to generate 50% or more annual returns, using call options and option spreads as our investment structure rather

7 Апрель, 2015 No Comment Read More

Follow Us

Sidebar Post

- Most Popular

- Recent Comments

-

Bollinger Bands Strategy With 20 Period ...

-

Pay Off Your Mortgage Prior To Retiremen...

-

You Say You Want A Dissolution An Overvi...

-

Pay Down the Mortgage Before Retirement ...

-

Volume indicator

-

Uncover Value Opportunities Using the Pr...

-

The Strategic Sourceror Top Tips for Rec...

-

How to pay off debt

-

Recessionproofing retirement

-

Frontier Markets The New Emerging Emergi...