Archive for Март, 2017

Pitfalls in Evaluating Risky Projects

Pitfalls in Evaluating Risky Projects

Loading. In recent years, the leaders of American companies have been barraged with attacks on their investment policies. Critics accuse American executives of shortsightedness

16 Март, 2015 No Comment Read More

Payback Period Overview The payback period is the time period required for the amount invested in an asset to be repaid by the net

16 Март, 2015 No Comment Read More

Capital budgeting is the process of analyzing and ranking proposed projects to determine which ones to invest in. There are three general methods for

16 Март, 2015 No Comment Read More

NPV vs IRR vs MIRR Pitfalls in the real world

NPV vs IRR vs MIRR Pitfalls in the real world

Author: Rahul Singh Lamba What is Capital Budgeting? Capital budgeting is the process of allocating capital after determining project feasibility. Determining project feasibility is

16 Март, 2015 No Comment Read More

NPV Calculator Calculate and Learn About Discounted Cash Flows

NPV Calculator Calculate and Learn About Discounted Cash Flows

The NPV Calculator on this page will help you to determine the desireability of an investment by instantly calculating its net present value. This

16 Март, 2015 No Comment Read More

NPV Calculator Net Present Value is today’s value for a project’s lifetime of cash flows. It is helpful if you understand the time value

16 Март, 2015 No Comment Read More

Net present value (NPV) method explanation example assumptions advantages disadvantages

Net present value (NPV) method explanation example assumptions advantages disadvantages

Net present value method (also known as discounted cash flow method ) is a popular capital budgeting technique that takes into account the time

16 Март, 2015 No Comment Read More

Net present value Wikipedia the free encyclopedia

Net present value Wikipedia the free encyclopedia

This article may be too technical for most readers to understand. Please help improve this article to make it understandable to non-experts. without removing

16 Март, 2015 No Comment Read More

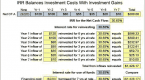

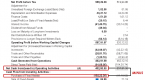

Go with the cash flow Calculate NPV and IRR in Excel

Go with the cash flow Calculate NPV and IRR in Excel

Have you been losing sleep figuring out the best way to maximize profitability and minimize risk on your business investments? Stop tossing and turning.

16 Март, 2015 No Comment Read More

SolveIT. The Financial Calculator v.5.5 A fast, easy-to-use collection of 33 financial calculators. Includes amortization, loan calculator. balloon, compound/simple interest, bond value & yields,

16 Март, 2015 No Comment Read More

Follow Us

Sidebar Post

- Most Popular

- Recent Comments

-

Bollinger Bands Strategy With 20 Period ...

-

Pay Off Your Mortgage Prior To Retiremen...

-

You Say You Want A Dissolution An Overvi...

-

Pay Down the Mortgage Before Retirement ...

-

Volume indicator

-

Uncover Value Opportunities Using the Pr...

-

The Strategic Sourceror Top Tips for Rec...

-

How to pay off debt

-

Recessionproofing retirement

-

Frontier Markets The New Emerging Emergi...