Archive for Март, 2017

The New York School of Bonds & Fixed Income Instruments

The New York School of Bonds & Fixed Income Instruments

Course Instructor Course Description The course gives an essential overview of the fixed income capital markets. Very good course leader, excellent techniques Analyst, Banco

16 Март, 2015 No Comment Read More

Study On Bond Valuation And Risk Management Finance Essay

Study On Bond Valuation And Risk Management Finance Essay

Duration is a term used by fixed-income investors, financial advisors, and investment advisors. It is an important measure for investors to consider, as bonds

16 Март, 2015 No Comment Read More

New Tool For Municipal Bonds Could Shock Investors

New Tool For Municipal Bonds Could Shock Investors

www.bondview.com/stresstest/bond/ Bondivew Stress Test of New York Portfolio Investors need to know that rising interest rates will significantly erode muni bond values.” said Robert

16 Март, 2015 No Comment Read More

Measurement of Interest Rate Risk in Fixed Income Securities

Measurement of Interest Rate Risk in Fixed Income Securities

The interest rate risk covers the relation of changes in yield and bond price changes, primarily based on the concepts of duration and convexity.

16 Март, 2015 No Comment Read More

Introducing QuantLib Duration and Convexity

Introducing QuantLib Duration and Convexity

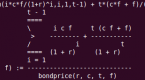

Introducing QuantLib: Duration and Convexity In this post Im going to explore QuantLibs support for assessing the riskiness of a bond. The riskiness of

16 Март, 2015 No Comment Read More

Interest rate risk Measure and avoid the pitfalls of duration Market Realist

Interest rate risk Measure and avoid the pitfalls of duration Market Realist

Why you should understand the key risks of fixed income investing (Part 3 of 7) Interest rate risk: Measure and avoid the pitfalls of

16 Март, 2015 No Comment Read More

How to Calculate Convexity Calculating the Convexity Calculate the Convexity

How to Calculate Convexity Calculating the Convexity Calculate the Convexity

Most Searched How to Calculate Convexity Convexity or convexity of a bond is the measure of the sensitivity of the duration of the bond

16 Март, 2015 No Comment Read More

FRMI Duration Tutorial Master the Art of Calculating Duration Convexity

FRMI Duration Tutorial Master the Art of Calculating Duration Convexity

Attend Repeat Telecast of the same webinar Risk management practices, in the wake of the financial crisis have become a need rather than a

16 Март, 2015 No Comment Read More

Federal Reserve Bank San Francisco

Federal Reserve Bank San Francisco

Measuring Interest Rate Risk for Mortgage-Related Assets Joe Mattey Measuring interest rate riskthat is, the risk that interest rate fluctuations might impair a firms

16 Март, 2015 No Comment Read More

What it is: Duration is a measure of a bond ‘s sensitivity to interest rate changes. The higher the bond’s duration, the greater its

16 Март, 2015 No Comment Read More

Follow Us

Sidebar Post

- Most Popular

- Recent Comments

-

Bollinger Bands Strategy With 20 Period ...

-

Pay Off Your Mortgage Prior To Retiremen...

-

You Say You Want A Dissolution An Overvi...

-

Pay Down the Mortgage Before Retirement ...

-

Volume indicator

-

Uncover Value Opportunities Using the Pr...

-

The Strategic Sourceror Top Tips for Rec...

-

How to pay off debt

-

Recessionproofing retirement

-

Frontier Markets The New Emerging Emergi...