Archive for Март, 2017

Volatility Fear Stocks and Gold

Volatility Fear Stocks and Gold

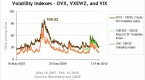

Volatility, Fear, Stocks and Gold Over the past 5 months we have seen volatility steadily decline as stocks and commodities rise in value. The

16 Март, 2015 No Comment Read More

Where to start looking for a market bottom with

Where to start looking for a market bottom with

Where to start looking for a market bottom with implied volatility. Perspective is easily lost if all you do is watch one slice of

16 Март, 2015 No Comment Read More

Volatility Index Uncovers Market Bottoms_1

Volatility Index Uncovers Market Bottoms_1

How to Make 20% in one Month on Your Favorite Stock (Using Options) Thursday, January 22nd, 2015 This week I would like to show

16 Март, 2015 No Comment Read More

Volatility Index Uncovers Market Bottoms

Volatility Index Uncovers Market Bottoms

VIX is a widely followed indicator of market volatility. Formally, VIX is known as the Chicago Board of Options Exchange (CBOE) Volatility Index. Informally,

16 Март, 2015 No Comment Read More

VNQ Fight Off Volatility With the Vanguard REIT Index Fund

VNQ Fight Off Volatility With the Vanguard REIT Index Fund

Recent Posts: Vanguard REIT ETF: Fight off Volatility With VNQ Since the Great Recession of the last decade, many have said that the era

16 Март, 2015 No Comment Read More

VIX Not Just an Indicator Any More

VIX Not Just an Indicator Any More

Exclusive FREE Report: Jim Cramer’s Best Stocks for 2015. Over the past two years the Chicago Board of Options Exchange Volatility Index, or VIX,

16 Март, 2015 No Comment Read More

TraderFeed More Bottom Up Stock Market Indicators and How to Use Them

TraderFeed More Bottom Up Stock Market Indicators and How to Use Them

More Bottom Up Stock Market Indicators and How to Use Them The previous post looked at three market measures that assess strength vs. weakness

16 Март, 2015 No Comment Read More

The MOVE Index Business Insider

The MOVE Index Business Insider

(This guest post originally appeared at the author’s blog ) Over the course of the last year we have witnessed one of the greatest

16 Март, 2015 No Comment Read More

S P 500 Volatility What does the VIX at 20 mean Trader Kingdom

S P 500 Volatility What does the VIX at 20 mean Trader Kingdom

Most investors are familiar with the unique negative correlation of the CBOE S&P 500 Volatility Index (VIX) and the S&P 500. In essence, when

16 Март, 2015 No Comment Read More

Royce Funds Commentary Great Expectations for SmallCap Active Management

Royce Funds Commentary Great Expectations for SmallCap Active Management

Page Title: Page URL: This page has been successfully added into your Bookmark. Widening credit spreads, increasing volatility, and decreasing stock correlation should allow

16 Март, 2015 No Comment Read More

Follow Us

Sidebar Post

- Most Popular

- Recent Comments

-

Bollinger Bands Strategy With 20 Period ...

-

Pay Off Your Mortgage Prior To Retiremen...

-

You Say You Want A Dissolution An Overvi...

-

Pay Down the Mortgage Before Retirement ...

-

Volume indicator

-

Uncover Value Opportunities Using the Pr...

-

The Strategic Sourceror Top Tips for Rec...

-

How to pay off debt

-

Recessionproofing retirement

-

Frontier Markets The New Emerging Emergi...