Archive for Март, 2017

Retirement Planning Using Monte Carlo Simulation to Test

Retirement Planning Using Monte Carlo Simulation to Test

Monte Carlo Simulation Helps Asses Risk in Your Plan You can opt-out at any time. Please refer to our privacy policy for contact information.

16 Март, 2015 No Comment Read More

Retirement Calculators Can Be Bad for Your Wealth

Retirement Calculators Can Be Bad for Your Wealth

Related Links (This article previously appeared on Paladinregistry.com . ) Life would be much simpler if you could input information into a retirement calculator

16 Март, 2015 No Comment Read More

Portfolio Optimization calculates optimal investment weightings for a basket of financial investments that gives the highest return for the least risk. Results display action

16 Март, 2015 No Comment Read More

Envision It! Workshop, October 5, 1996 Steve McKelvey Department of Mathematics Saint Olaf College Excel and Simulation In addition to formulaic analysis of datasets,

16 Март, 2015 No Comment Read More

Monte Carlo software can help with retirement planning

Monte Carlo software can help with retirement planning

Demeuse (Photo: Submitted) The theme of many articles focuses on saving for retirement. Obviously, these articles go on to say people are afraid of

16 Март, 2015 No Comment Read More

>But there’s a spreadsheet, right? Yes, you can use a spreadsheet which looks like this: if’n that’s what you like to see. Actually, the

16 Март, 2015 No Comment Read More

Monte Carlo Simulation The Basics

Monte Carlo Simulation The Basics

What Is a Monte Carlo Simulation and Why Do We Need It? Analysts can assess possible portfolio returns in many ways. The historical approach,

16 Март, 2015 No Comment Read More

Monte Carlo Simulation Approach To Value At Risk Finance Essay

Monte Carlo Simulation Approach To Value At Risk Finance Essay

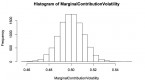

The value at risk (VaR) methodology is widely used in Risk Management in order to quantify the inherent portfolio risk that may arise as

16 Март, 2015 No Comment Read More

Monte Carlo Simulation and Options

Monte Carlo Simulation and Options

If your interest is finance and trading, then using Python to build a financial calculator makes absolute sense. As does this book which is

16 Март, 2015 No Comment Read More

Monte Carlo methods in finance Wikipedia the free encyclopedia

Monte Carlo methods in finance Wikipedia the free encyclopedia

From Wikipedia, the free encyclopedia Monte Carlo methods are used in finance and mathematical finance to value and analyze (complex) instruments. portfolios and investments

16 Март, 2015 No Comment Read More

Follow Us

Sidebar Post

- Most Popular

- Recent Comments

-

Bollinger Bands Strategy With 20 Period ...

-

Pay Off Your Mortgage Prior To Retiremen...

-

You Say You Want A Dissolution An Overvi...

-

Pay Down the Mortgage Before Retirement ...

-

Volume indicator

-

Uncover Value Opportunities Using the Pr...

-

The Strategic Sourceror Top Tips for Rec...

-

How to pay off debt

-

Recessionproofing retirement

-

Frontier Markets The New Emerging Emergi...