Archive for Март, 2017

What The Dow Can Tell Us About Past And Present Markets

What The Dow Can Tell Us About Past And Present Markets

A review of DJIA history provides interesting insights and new thoughts. DJIA Research A review of Dow history should provide some interesting insights as

16 Март, 2015 No Comment Read More

Strength vs Weakness In this lesson you will learn how to evaluate the Strength or Weakness in a market. It is not enough for

16 Март, 2015 No Comment Read More

Overnight vs Daytime Markets Two Very Different Animals

Overnight vs Daytime Markets Two Very Different Animals

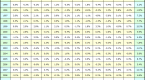

Overnight vs Daytime Markets: Two Very Different Animals 30Sep10 I’m going to do a series of posts (inspired by Woodshedder ) on stock market performance

16 Март, 2015 No Comment Read More

A Brief History of Bear Markets (^DJI ^GSPC)

A Brief History of Bear Markets (^DJI ^GSPC)

Sources: Yahoo! Finance, author’s calculations, and numerous history-laden websites. *Assumes multiple bear rallies but no official recovery until post-1942. **By percentage drop. Assumes three

16 Март, 2015 No Comment Read More

The Motley Fool UK Fool School 19

The Motley Fool UK Fool School 19

Apologies FOOL SCHOOL Valuation: P/E And PEG Ratios September 19, 2005 This is the first in a series of articles looking at how to

16 Март, 2015 No Comment Read More

S P 500 Operating EPS Estimates Are Too Optimistic and the Market Is Expensive

S P 500 Operating EPS Estimates Are Too Optimistic and the Market Is Expensive

Deep value, contrarian, and Grahamite investment S&P 500 Operating EPS Estimates Are Too Optimistic and the Market Is Expensive If your valuation models use

16 Март, 2015 No Comment Read More

PE ratios can vary dramatically depending on the E that you choose

PE ratios can vary dramatically depending on the E that you choose

Q: Why would a stock’s price-to-earnings ratio be a low 3.3 based on trailing earnings and a high 104 for future earnings? A: The

16 Март, 2015 No Comment Read More

Q: If someone wants to buy a stock, should they consider the forward P/E or the current P/E? A: The price-to-earnings ratio or P/E

16 Март, 2015 No Comment Read More

ETF Trade Execution Quality during the Flash Crash Month Omer Uzun

ETF Trade Execution Quality during the Flash Crash Month Omer Uzun

ETF Trade Execution Quality during the Flash Crash Month 0 comments Subtitle: Some market orders received better price execution than limit orders. Recently, all

16 Март, 2015 No Comment Read More

2010 Food Crisis for Dummies Eric deCarbonnel (Editor’s Note: If you read any economic, financial, or political analysis for 2010 that doesnt mention the

16 Март, 2015 No Comment Read More

Follow Us

Sidebar Post

- Most Popular

- Recent Comments

-

Bollinger Bands Strategy With 20 Period ...

-

Pay Off Your Mortgage Prior To Retiremen...

-

You Say You Want A Dissolution An Overvi...

-

Pay Down the Mortgage Before Retirement ...

-

Volume indicator

-

Uncover Value Opportunities Using the Pr...

-

The Strategic Sourceror Top Tips for Rec...

-

How to pay off debt

-

Recessionproofing retirement

-

Frontier Markets The New Emerging Emergi...